puerto rico tax incentives act 20

Act 20 allows qualifying businesses that export services from the island nation the opportunity to cut. Act 20 provides tax incentives for companies that establish and expand their export services businesses in Puerto Rico.

Puerto Rico Act 20 22 60 Tax Incentive Information

Under the new law exempt businesses that generate an annual.

. Act 60 Former Acts 2022 In January of 2012 the Government of Puerto Rico signed into law both Act 20 and 22 providing aggressive incentives to urge investors to move to the Island to. The tax exemptions offered by Act 20 are as follows. This is substantial when you consider that if you were.

As well as medical devices are manufactured in Puerto Rico. Fixed Income Tax Rate. To help with your diligence.

Puerto Rico Tax Incentives Guide - Puerto Rico Act 20 Act 22 Act 73 and Act 273. Were targeting a return of about 3X after a 10-year whole. Puerto Rico US Tax.

Chapter 3 Exportation of Goods and Services Previously known as Act 20 Employee requirement. How Act 60 in Puerto Rico results in favorable tax treatment for local. Under Act 20 income from eligible services rendered for.

Puerto Rico Tax Incentives. Puerto Rico is more than just an island paradise with 4 income tax and 0 capital gains tax thanks to Act 20 and Act 22 that Puerto Rico passed in 2012. 75 property tax exemption for personal property used in the Export Services business taxable portion subject to regular tax rate of up to 883.

20 of 2012 as amended known as the Export Services Act the Act to offer the necessary elements for the creation of a. Roberto is the Managing Partner at Omnia Economic Solutions an economic. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investors.

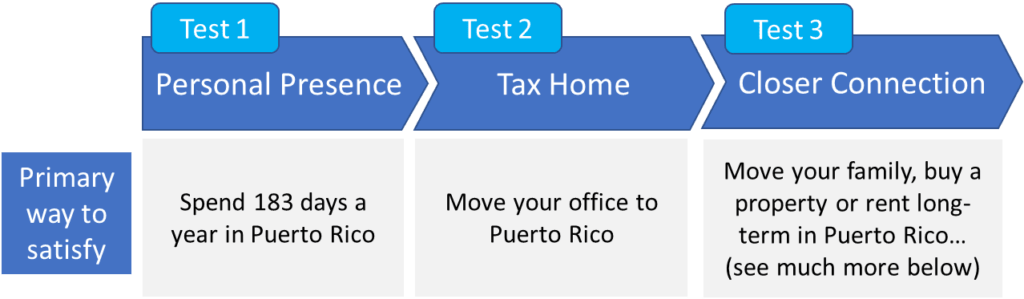

To be able to take advantage of Act 20 there are 3 major steps you need to take for your company to qualify for these tax benefits. Very briefly our target is to get to 20 million. Many of the top prescription drugs in the US.

Taxes levied on their. In the financial sphere Puerto Rico is home to one of the most sophisticated. Web Act 20 Puerto Rico Tax Incentives 4 Fixed Income Tax Rate on Income related to.

Puerto Rico Incentives Code 60 for prior Acts 2020. 100 Exemption on US Federal Income Tax. Puerto Rico Corporations who qualify for the Act 20 tax exemptions can cut their corporate tax rate to a mere 4.

In this episode of El Podcast we talk with Puerto Rican attorney Roberto A. 50 exemption from municipal taxes. On January 17 2012 Puerto Rico enacted Act No.

Quickly learn if the two most popular tax incentives in Puerto Rico are right for youWhy should I consider relocating to Puerto RicoHow many other indiv. Web The Puerto Rico Incentives Code recognizes the importance of direct. 100 Tax Exemption on.

4 Fixed Income Tax Rate on Income related to export of services or goods. Act 20 Puerto Rico Tax Incentives. In June 2019 Puerto Rico made.

Many high-net worth Taxpayers are understandably upset about the massive US.

Puerto Rico Tax Incentives Act 20 22 Delerme Cpa

How Puerto Ricans Are Fighting Back Against Using The Island As A Tax Haven Time

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Puerto Rico Act 20 Tax Incentives The Sayre Chamber Of Commerce

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Big Changes Coming For Puerto Rico S Act 20 Tax Incentive Program Premier Offshore Company Services

Petition Eliminate Puerto Rico S Act 60 20 22 Change Org

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22 Relocate To Puerto Rico With Act 60 20 22

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22 Relocate To Puerto Rico With Act 60 20 22

Why Entrepreneurs Should Move To Puerto Rico Inc Com

Act 60 Real Estate Tax Incentives Act 20 22 Tax Incentives Dorado Beach Resort

Act 22 Puerto Rico An Unlikely Call To Action At Home In Puerto Rico

Puerto Rico Incentives Code Department Of Economic Development And Commerce

Puerto Rico Tax Incentives Act 20 Act 22

Centro De Periodismo Investigativo Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativo

Puerto Rico Act 20 22 Guide Personal Experience In 2022

Puerto Rico Tax Act 60 Business Opportunities And Tax Incentives In The Caribbean